Best Affordable Life Insurance For Seniors

I want to teach you how to become your bank. Forget groveling to Wells Fargo when you need a home or car loan. Don’t run to JP Morgan or Bank of America and get on bended knee to beg for a loan to buy a business. Take control of your life. Everyone should know about the best affordable life insurance for seniors.

It’s time to start the bank of you. In this video, I will explain how to harness the power of the Best Affordable Life Insurance for Seniors to build real wealth, to build your own bank, so you can control your time and what you do with it. By the end of the video, it will become clear to you, maybe for the first time, that a clear path exists for you to become rich.

Life insurance for older people is similar to regular life insurance but may have different coverage based on age and needs. Younger people may have better life insurance options than older people. However, whole life insurance will cover your entire life, regardless of when you pass.

Some plans offer a cash value component that you can use to help pay off major expenses like mortgages and medical bills. Additionally, most plans provide a death benefit, which gives a portion of the money to your beneficiary when you pass away.

Your plan’s cash value and death benefit may vary depending on how much you spend on premiums. Choosing a life insurance plan for older people can help your family prepare for the future and focus on healing.

Best Life Insurance For Seniors

Life insurance is one of the most reliable ways to provide for loved ones after you pass. Finding the best affordable life insurance for seniors is essential. But you may find it difficult to decide which policy is right for you.

What type of Best Affordable Life Insurance for Seniors should you have? How much is enough? What is the best life insurance at your age?

Life insurance for older people varies from company to company, may involve a medical exam (also called a life insurance exam) or simply answering health questions, costs anywhere from $15 a month to several thousand dollars a month, and can be used for everything from mortgages to covering small bills like funeral expenses.

Finding the Best Affordable Life Insurance for Seniors takes some research. While it’s true that you’ll pay more for life insurance once you’re past your golden years, that doesn’t mean you don’t have options. Affordable senior life insurance policies exist for those who want to leave cash benefits for their families — or those who want to make sure their final expenses are covered.

You may be able to pay as little as $15 per month, or you may pay more than $1,000 per month. In this article, we’ll cover all your options — including ultimate cost insurance for older people — so you can make the right decision.

What Is The Best Life Insurance For Seniors?

You can begin addressing these questions by evaluating your financial situation. We get various information about the best affordable life insurance for seniors. For instance, do you have a spouse, children, or other dependents relying on you? Are there significant expenses like a mortgage or car payments that will need to be covered after you’re gone?

If someone in your life depends on your financial support, it’s wise to consider a policy to safeguard them from unexpected costs. Even if you believe your dependents are adequately provided for, life insurance remains valuable because your family might face estate taxes, end-of-life medical bills, and burial expenses (which can exceed $9,000).

Determining the appropriate coverage amount depends on various personal factors, including marital status, debts, assets, and end-of-life objectives. As a general guideline, The Wall Street Journal suggests purchasing coverage equivalent to 8 to 10 times your annual income. If you have life insurance through your employer, keep in mind that it may not be sufficient and could expire by the time you retire.

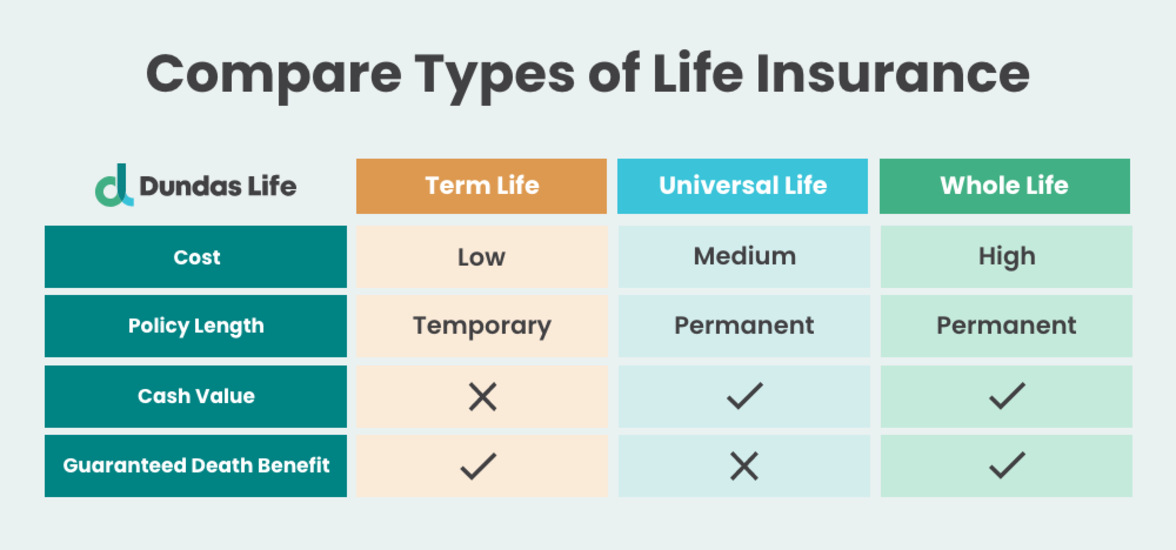

Here are considerations for each major policy type to assist you in selecting the best life insurance for older people:

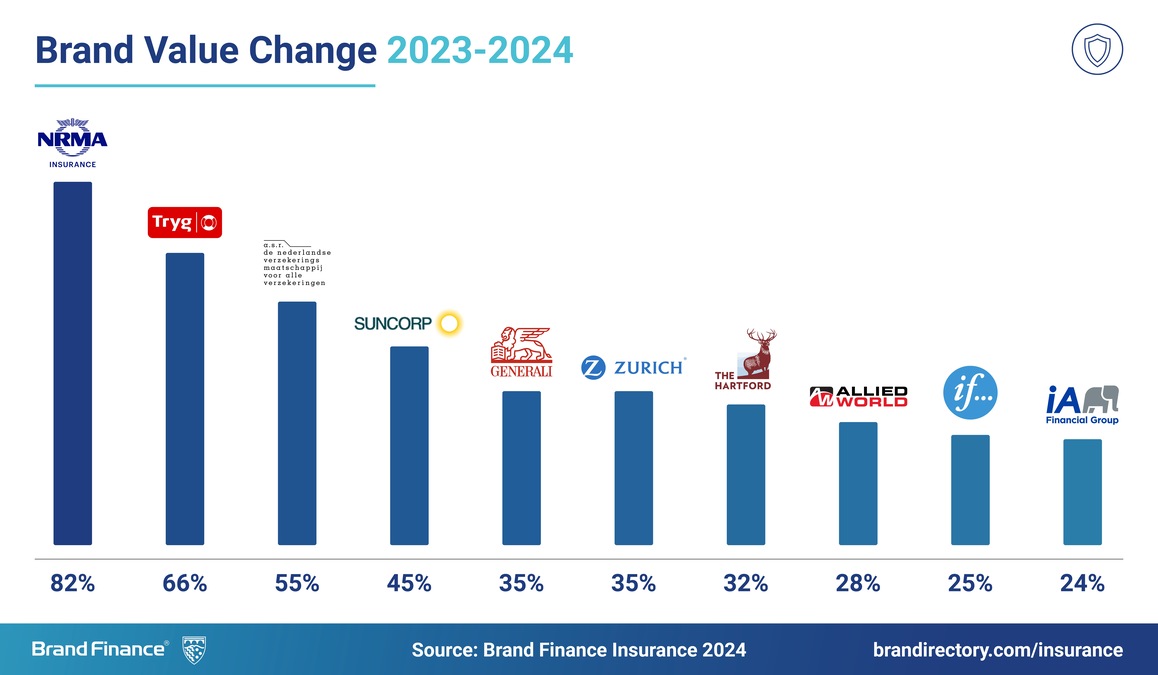

The Best Life Insurance Companies For Seniors

Adults seeking optimal life insurance should contemplate companies offering suitable coverage options. Based on customer satisfaction scores and digital tool availability from Power Studies, these life insurance companies rank highly according to Bankrate’s Coverage Options for Seniors, AM Best’s Financial Strength Rating, and the 2023 J.D. Power Studies. However, the best choice for you may vary depending on your personal preferences and other financial considerations.

What Type Of Life Insurance Policy Is Best?

There are many different types of life insurance for seniors to choose from, and each option has potential advantages and disadvantages. Understanding the different types of life insurance can help you make the best choice for your individual needs.

Term Of Life Insurance For Seniors:

Term life insurance typically covers a fixed period, ranging from 10 to 30 years. With a conversion rider, you can convert to permanent life insurance before your policy expires. As you age, term policies become more expensive. older people considering term life insurance should plan for future budget adjustments and renewal at the term’s end.

Best Affordable Life Insurance for Seniors covers you until death (in most cases) or until you choose to surrender the policy, provided premiums are paid and terms are met. The two main types are whole life insurance and universal life insurance, each with subtypes like variable universal life insurance. While more expensive than term life insurance, permanent insurance offers peace of mind by providing financial support to loved ones after your death.

Guaranteed Acceptance of Whole Life Insurance For Seniors

Guaranteed acceptance Best Affordable Life Insurance for Seniors, also known as guaranteed issue whole life or final expense insurance, offers coverage without medical examinations as long as age requirements are met. Coverage amounts are typically low, ranging from $10,000 to $25,000, often used to cover funeral expenses including headstones and funeral home fees.

PROS:

- No medical examination required

- Coverage is generally guaranteed for ages 50 to 80

CONS:

- Premiums may be higher relative to coverage amount

- Potential waiting period for death benefits

- Coverage amounts are typically low

How To Choose The Best Senior Life Insurance Policy

Now, when most people think about life insurance, they tend to primarily focus on the death benefit—the amount their beneficiaries will receive if they pass away while the policy is active. But there is another key component of life insurance that often goes overlooked: borrowing from the cash value of the policy. You borrow from yourself, not a bank.

Seniors generally have different priorities than other age groups. They may be paying off debt, planning for retirement, providing for children and grandchildren, or preparing for end-of-life expenses. Before buying life insurance, it can be helpful to understand the factors you need to consider at different ages.

Life Insurance For Seniors Over 60

In your 60s, you may still be working and starting to think about retirement. This may be a good time to ensure you have the Best Affordable Life Insurance for Seniors because premiums are generally less expensive as you age. You may consider replacing lost income for a spouse or other dependents if you were to die suddenly. Additionally, if you have children or grandchildren (or plan to in the future), you may want to consider leaving a financial gift for them upon your death.

Life Insurance For Seniors Over 70

By your 70s, you may be retired. Replacing lost income for a spouse or loved one may not be a factor in purchasing life insurance at this stage. However, consider the financial impact on your family if you were to pass away.

Are you still paying a mortgage or other debts? Do you have enough savings to cover your funeral expenses and any remaining end-of-life expenses for your loved ones? Best Affordable Life Insurance for Seniors can help alleviate the financial burden of your death for your loved ones and provide a financial legacy for them after you’re gone.

Life Insurance For Seniors Over 80

If you are 80 or older, your life insurance options may be limited. You should consider all the same factors as in your 70s, but understand that if you didn’t secure insurance at a younger age, your choices may be more restricted now.

A final expense policy may be the best option for obtaining coverage, though the death benefit may be lower and the premium higher. If you’re having difficulty finding the coverage you need, consulting with a licensed insurance agent or financial professional about your options can be beneficial.

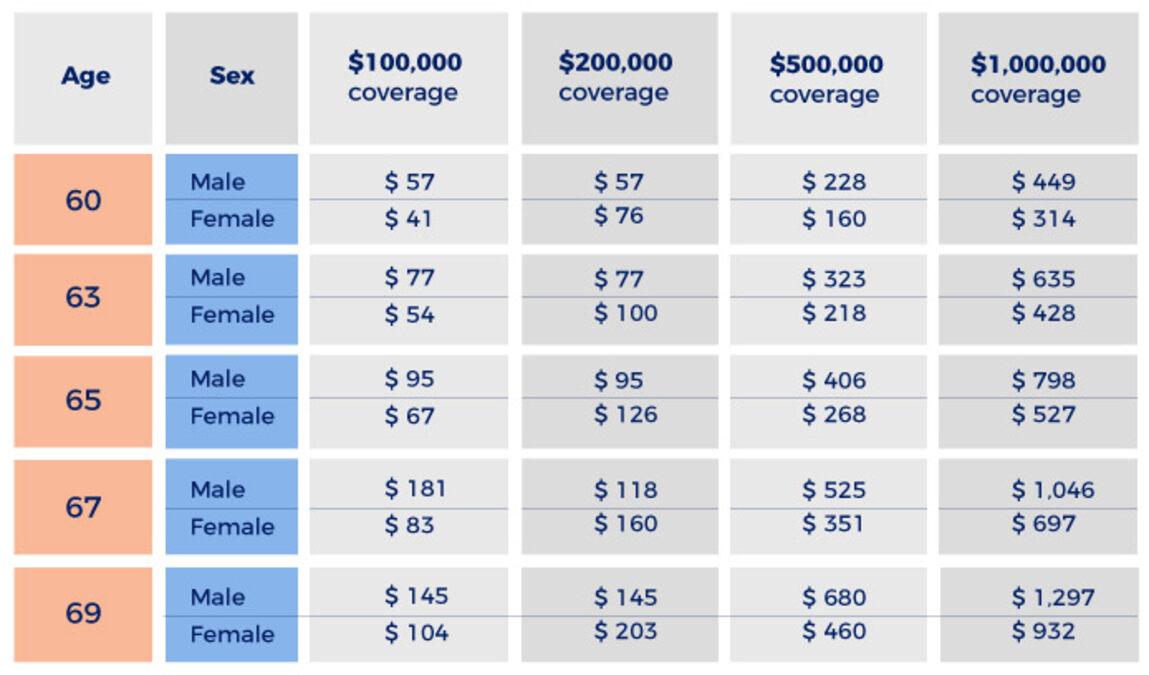

How Much Is Life Insurance For Seniors?

There are several factors that contribute to the cost of a life insurance policy. The main factors are gender, lifestyle, age, and health history. Generally, younger people pay less for life insurance than older people.

Additionally, healthy individuals will generally pay less for life insurance than those with pre-existing health conditions or those who smoke.

When looking for the Best Affordable Life Insurance for Seniors, it’s important to remember that term life insurance is generally less expensive than a permanent policy, but these costs increase as you age, regardless of the policy type.

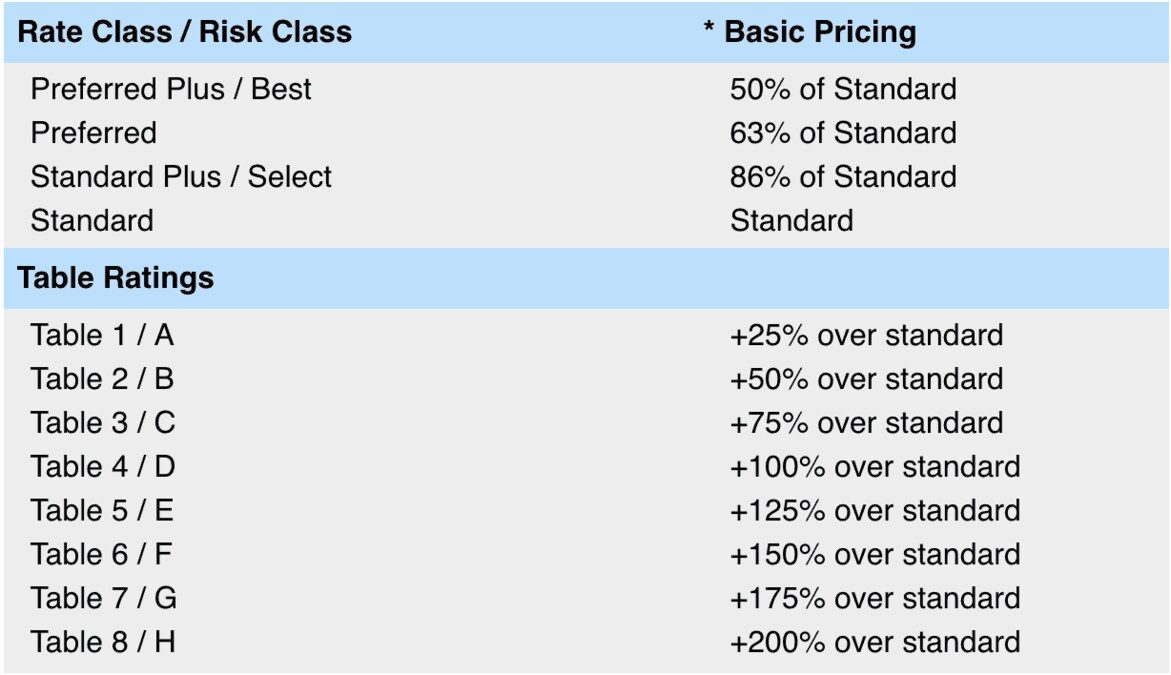

If you purchase a medically underwritten life insurance policy, the cost will be highly personalized based on specific rating factors. Costs for policies such as final expense or guaranteed acceptance policies, which are not medically underwritten, will not vary much in price.

Before buying life insurance, you may still want to shop around and get quotes from multiple life insurance companies to find the best option for you.

How We Ranked The Top Life Insurers

NerdWallet’s Best Affordable Life Insurance for Seniors rating is a weighted average of consumer experience, the National Association of Insurance Commissioners Complaint Index score for individual life insurance, and the Financial Strength Rating, which indicates a company’s ability to pay future claims.

Within the consumer experience category, we consider ease of communication and website transparency, assessing the depth of policy details available online. To calculate each insurer’s rating, all scores are combined on a curved 5-point scale.

These ratings are a guide, but we encourage you to shop around and compare different insurance quotes to find the best rate for you. NerdWallet does not receive compensation for any reviews. Read our editorial guidelines.

Other Life Insurance Options For Seniors

If you can’t find a traditional term or Best Affordable Life Insurance for Seniors, there are alternatives to consider, such as guaranteed issue life insurance. These policies do not require a life insurance medical exam, and acceptance is guaranteed.

Alternatively, you may want to look into burial insurance, sometimes referred to as final expense insurance. These are smaller whole life policies that can help cover end-of-life expenses such as funeral expenses.

Alternatives To Term Life Insurance

Just because term coverage is usually the cheapest type of life insurance doesn’t mean it’s always the right choice.

For example, if you want permanent coverage for life, consider a permanent life insurance policy. There are also life insurance policies designed to meet specific needs, such as covering the cost of a funeral.

Whole Life Insurance:

The most straightforward and affordable type of Best Affordable Life Insurance for Seniors. Provides lifetime coverage and an assured death benefit as long as you pay your premium.

Universal Life Insurance (UL)

Offers lifetime coverage and a cash value account. Types of UL include Variable Universal Life (UL), Guaranteed Universal Life (GUL), and Indexed Universal Life (IUL). Premiums and/or death benefits may be flexible depending on the type of policy.

The cash value growth of the policy is usually related to a market index or sub-account performance, depending on the type of policy. Generally considered more flexible than whole life insurance.

Burial Insurance (Funeral Insurance)

Designed to help your loved ones with final expenses such as burial or funeral expenses, outstanding medical bills, etc., although benefits can be used to cover other expenses. Coverage amounts are low, typically $10,000 to $25,000. Shopping for senior life insurance is often an option if they don’t qualify for other types of life insurance. Structured as a permanent life insurance policy.

Survivorship Life Insurance

A single policy that covers one person, like husband/ wife. Only the death benefit is paid if both persons die.

No-Exam Life Insurance

Usually available as term life insurance, though it can be permanent coverage. No-exam life insurance is more expensive than other types of coverage. Life insurance can be a good option for those who find it difficult to obtain coverage due to medical issues.

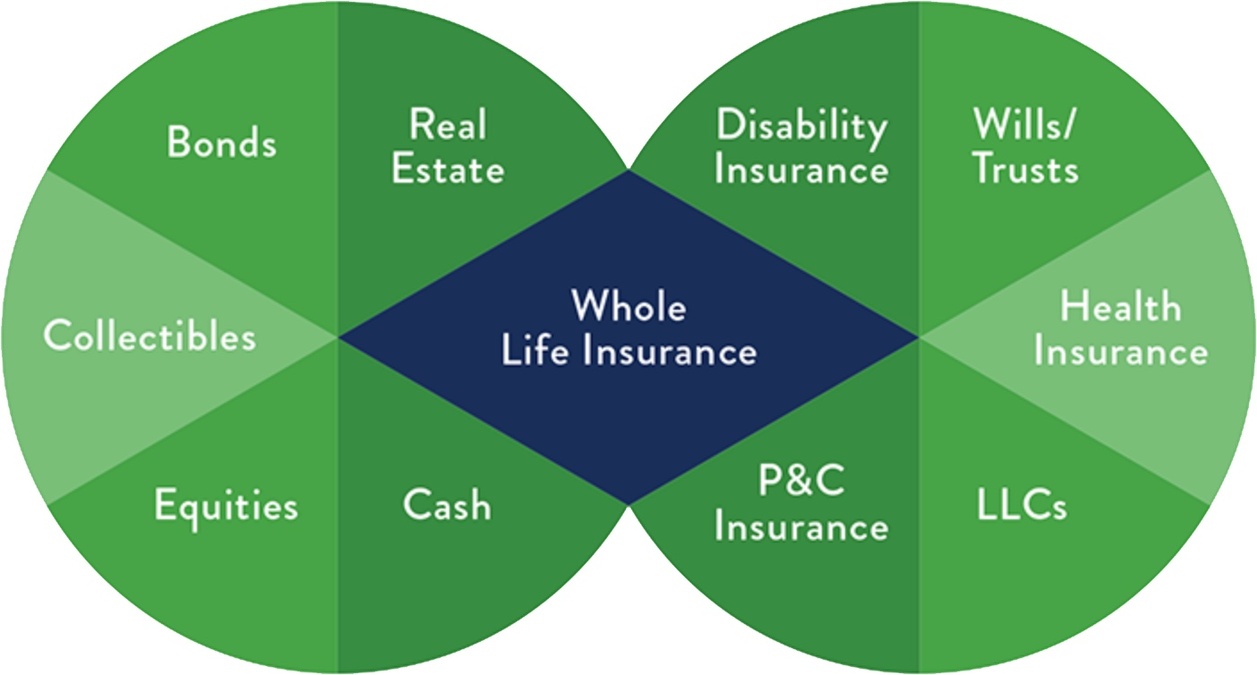

Use Whole Life Insurance to Get Rich

While life insurance may seem like just another expense at first glance, the truth is that it can be a powerful tool for building wealth over time. I mean, you see investing in an IRA or 401K as an expense, probably not. You see it as an investment for your future retirement.

But what if I told you that an IRA or 401k is a worse investment than a life insurance policy? If you think about it, when you invest in an IRA or 401K, you’re putting your money in shackles. You are bound to it until you are 59 years old. Bye-bye money, you say. It becomes worthless to you now; a pet rock serves you well.

How Much Life Insurance Do You Need?

You should have enough Best Affordable Life Insurance for Seniors to cover the needs of your dependents. This usually means taking into account one or more of the following:

- Your annual salary and how many years you want to replace it if you die during your working years.

- Existing debt that a dependent will have to take on after your death, such as a mortgage.

- Educational expenses for children, such as tuition.

- Whether you want to cover your final expenses, such as a funeral.

- Any legacy you may want to leave to your life insurance beneficiaries.

Estimating costs can be difficult, especially if you factor in career changes, inflation, retirement, or other investment assets and milestones such as having a child or buying a home. In many cases, the most effective way to determine which type of life insurance is best for your needs is to contact a professional.

How Much Is Life Insurance For Seniors?

Several factors contribute to the cost of a life insurance policy. The main factors are age, health history, gender, and lifestyle. Generally, younger people pay less for life insurance than older people. Additionally, healthy individuals will generally pay less for life insurance than those with pre-existing health conditions or those who smoke.

When looking at Best Affordable Life Insurance for Seniors, it’s important to remember that term life insurance is generally less expensive than a permanent policy, but these costs increase as you age, regardless of policy type.

If you purchase a Best Affordable Life Insurance for Seniors that is medically underwritten, the cost of your policy will be highly personalized as we all have our own specific rating factors. Costs for policies such as final costs or guaranteed acceptances that are not medically underwritten will not vary much in price.

Before buying life insurance, you may still want to shop around and get quotes from multiple life insurance companies to find the best option for you.

Life Insurance for Seniors With No Medical Exam

Most life insurance policies require a medical exam, which in part determines whether the insured is eligible for coverage and at what cost. Some companies offer no-exam policies, which typically cost more than traditional policies but extend coverage to applicants with medical conditions. Some no-test policies are guaranteed issue plans, which means the company can’t deny you coverage until you meet the age and death benefit requirements.

System for Rating the Best Life Insurance Companies

Our team researches and ranks the Best Affordable Life Insurance for Seniors using an in-depth scoring system that takes into account the factors most important to consumers like you. Our analysis includes a comprehensive review of each provider we feature based on available coverage, availability, customer service, company reputation, and customizability. Here are the factors we consider when rating life insurance providers:

Final Expense Insurance For Seniors

Final expense insurance—also called “burial insurance” or “funeral insurance“—is Best Affordable Life Insurance for Seniors that helps cover your loved one’s end-of-life expenses. Today, funerals cost more than $9,000, according to the National Funeral Directors Association.

Final expense policies are popular with seniors because you often don’t have to pass a medical exam to qualify—coverage is issued based on answers to health questions on the application. Policy rates are generally more affordable than other types of life insurance because the policy amount is usually much lower, typically $10,000–$15,000.

Affordable Life Insurance For Seniors

In general, final expense insurance is usually the most affordable because you can buy a policy for as little as $15 a month. Final expense plans are perfect for old people on a fixed income or those who may have trouble qualifying for a larger policy.

When determining how much Best Affordable Life Insurance for Seniors you can afford, consider your overall budget and future changes. Some may look for the cheapest life insurance available, but many times these policies are not for old people. Choose a policy with the most benefits to help surviving loved ones.

The cost of your policy will depend on your gender, age, overall health, and the type of coverage you are taking. If your goal is to ensure that your loved ones are not left behind with funeral expenses, you only need a final expense insurance policy. But if you want to leave more to your beneficiary, a term or whole-life plan may be better if you can afford it.

No Medical Exam Life Insurance For Seniors

Some people think they won’t be approved for senior life insurance because of their age or health. However, improvements in insurance underwriting and the availability of specialty insurers that focus on covering high-risk individuals mean that life insurance is available to almost everyone.

Once you’ve found a company and policy that meets your needs, you’ll be asked to fill out an application. To be approved for coverage, you will need to provide certain information about yourself, such as your age, weight, height, any health conditions you have, and any life insurance you already have.

For some insurances, you may be asked to complete a medical exam to qualify. It is important to answer all questions honestly when completing your application so that your coverage can be issued correctly. Misrepresentation of information may result in the cancellation of your policy or denial of death benefit if incorrect information is provided.

Guaranteed issue Best Affordable Life Insurance for Seniors (also known as guaranteed Best Affordable Life Insurance for Seniors ) plans also exist, but they are often very expensive and do not fit most.

Insurance for Seniors

A life insurance policy is far superior to an IRA or a 401K. With a life insurance policy, you can allow the interest of the policy to accrue and compound just like in an IRA or 401K. But with a life insurance policy, the interest is guaranteed. Your IRA and 401K are not guaranteed. But even better, you can take out a loan against Best Affordable Life Insurance for Seniors to purchase an asset that gives you more cash flow, like a real estate purchase or buying a business. Try doing that with your IRA or 401K.

Life Insurance Quotes for Seniors

If you’re concerned about finding an affordable life insurance policy that’s easy to qualify for, consider getting a policy from Lincoln Heritage Life Insurance Company®.

We are the nation’s leading final expense insurance company and can qualify most people, even those with health issues. The best affordable life insurance plans for seniors are widely known today.

We have been serving seniors and their families since 1963. Best of all, our policies require no medical exam—just answer the health questions on our 1-page application. We will work with you to find the best life insurance for seniors within your unique needs and your budget.

Common Life Insurance for Seniors

Since life insurance generally becomes more expensive as you age, older people may have fewer options when it comes to policy availability and cost. Here are some life insurance choices for seniors whose prices may be beyond standard life insurance coverage. Guaranteed the best affordable life insurance for seniors in all countries of the world.

Having some type of life insurance plan is a great way to help provide support and comfort for your loved ones after your death. Finding the right life insurance can help your family cover funeral expenses and new bills after losing a loved one. This type of financial support allows your family to focus on the grieving process instead of stressing about end-of-life expenses.

There are various senior life insurance plans to choose from at Law Point, which play an important role in our lifestyle. older person life insurance works similarly for other age groups. However, most companies have age restrictions that affect which plans are available. We can help you find a plan that can provide the coverage you’re looking for.

Once you find the Best Affordable Life Insurance for Seniors plan that suits your needs, you pay regular premiums to keep the policy active. Some plans have cash value aspects that you can access early, and most plans offer a death benefit that your beneficiary will receive (subject to limitations and exclusions) when the plan ends.

The Best Senior Life Insurance Policy

With these tips, you can choose the best life insurance policy for your financial situation and needs:

Figure Out Your Coverage Needs

First, think about why you want senior life insurance. Maybe your goal is to pay for your burial and funeral expenses. Or perhaps you want to continue an income for a partner when your pension no longer applies, fund a functional needs trust, or provide funds to cover large debts for your family.

Compare Policy Types

There are two most common types of life insurance: term and whole life insurance. While term life insurance is temporary and covers you for a period of time, whole life insurance lasts for a lifetime.

Generally, term life insurance plans can be 10, 20, or 30 years long. With this type of plan, policyholders must pass through the selected period for beneficiaries to receive benefits. The older you are, the shorter the term can be.

It is also possible that the fee increases with age. Term life insurance is still a popular choice that can still provide benefits for loved ones.

Whole Life Insurance

As you get older, providing security for your loved ones can feel even more stressful. Whole life insurance is another great option for older people that will provide coverage for the entire life cycle of a policyholder. By securing the best affordable life insurance for seniors, they can confidently save for their loved ones.

Unlike term life insurance, whole life insurance benefits are usually payable to your beneficiary regardless of when you pass. Whole life insurance can be a good option if you want to be sure that your family will benefit upon your death.

Final Cost Insurance

Final cost insurance is a permanent life insurance policy that pays a small death benefit if you die. Your beneficiaries can use the payment to cover your funeral, burial costs, and other end-of-life expenses. Since final expense insurance is a smaller type of plan, it usually comes with lower premiums than other permanent life insurance policies. Aflac offers final cost whole life insurance that can give older people the coverage they need.

Benefits of Senior Life Insurance

Finding the best affordable life insurance for seniors is important to us. Here are some benefits of getting life insurance for older people:

Reasonable Premiums

While the rates you pay for life insurance depend on the type of plan you get and other factors, many policies offer reasonable premiums that fit your budget.

Coverage Tailored to Your Needs

From term life insurance to permanent policies, there is plenty of life insurance at your disposal. Based on your needs and budget, you can find the right policy.

Peace of Mind

A senior life insurance policy can give you peace of mind. You will be happy to know that your loved one will have financial support in your absence. They can use the death benefit payout to cover any expenses after you pass.

Find the Best Life Insurance for Seniors

Finding the best affordable life insurance for seniors can help them save for the last moments of their lives, which they can use for cremation expenses after death. When you’re looking for the best type of life insurance for an old man, we recommend considering how much coverage you need and how much you want to spend. We can help you combine these two factors and find a life insurance plan that works for you.

Finding the right life insurance company is just as important as finding the right plan. As mentioned earlier, there are different types of plans to best help meet the specific needs of old men.

Whether your goal is to spend less or be more secure, you have options to help you determine the best life insurance for you and your loved ones. With more than 50 years of experience, Aflac may be able to help you find the coverage you’re looking for.

How Much Life Insurance Should Old People Get?

Finding the best affordable life insurance for seniors can help them save for the last moments of their lives. How much life insurance you should invest as a senior depends on several factors. This includes your coverage needs and financial obligations, the type of life insurance policy you want, and how much you can afford.

If you want your policy to cover a funeral service, for example, you’ll likely need less coverage than a senior who wants their policy to pay off a significant mortgage balance.

Should Old People Get Life Insurance?

As a senior, you can benefit from a life insurance policy. There are several reasons for that. Death benefits can provide financial security for beneficiaries and help them pay off various expenses, such as funeral expenses, medical bills, and remaining debts, such as mortgages, credit card bills, and auto loans.

A life insurance policy can come in handy if you are a married older citizen. Also, it can come in handy if you are raising one or more grandchildren. Everyone wants to find the best affordable life insurance for seniors.

As you retire, you may think more about your family’s future. Whether you already have coverage or are shopping for your first policy, you can find whole-life insurance for people over 60, which can provide you with the peace of mind that your family won’t receive a bill after you pass. It can be an important addition to what you already have.

Although many policies available for old people do not offer the same amount of coverage as fully underwritten policies that you might purchase at a younger age, they still offer significant benefits. Life insurance guarantees are based solely on the claim-paying ability of the issuer. The guarantee remains effective until you pay all premiums. You probably won’t be able to buy the

Life Insurance Ratings

The life insurance rating is a weighted average of consumer experience, the National Association of Insurance Commissioners Complaint Index score for individual life insurance, and the financial strength rating, which indicates a company’s ability to pay future claims.

Within the consumer experience category, we consider ease of communication and website transparency, which assess the depth of policy details available online. To calculate insurers’ ratings, we combine scores on a curved 5-point scale.

These ratings are a guide, but we encourage you to shop around and compare different insurance quotes to find the best rate for you.

Life Insurance for Seniors

If you are concerned about finding an affordable life insurance policy that is easy to qualify for, consider getting a policy from a reputable life insurance company. They are the leading final expense insurance company in the country and can help most people qualify, even serving families with health issues.

Best of all, their policies don’t require a medical exam—you just have to answer health questions on a 1-page application. They will work with you to find the best life insurance for older people according to your needs and budget.

You may no longer need as much life insurance as you enter your golden years. Your children have likely grown and become independent, and your spouse will rely on Social Security and retirement savings rather than your income. Life insurance is still important, though. Small whole-life policies for people older than 70 can help your family with several common end-of-life expenses.

life insurance is an investment

While you were working, raising a family, saving for your kids’ college, and paying off a mortgage, you and your spouse each needed enough life insurance to replace your take-home pay for at least two or three years to support the family and maintain their lifestyle in your absence.

If you have fulfilled most of these obligations, it may be a good time to reassess whether you still need your current life insurance.

You should discuss this with your spouse or partner, your children or other beneficiaries, a trusted financial advisor, and your insurance professional.

Always ensure you have enough money to cover any expenses after your death, such as a funeral, burial, taxes, and debts. You don’t want to leave them to your loved ones.

Note that some Best Affordable Life Insurance for older people can help pay medical expenses while you are alive, but this will reduce or eliminate the death benefit.

Comments (1)

Best Money Investment For Beginners In 2024says:

July 17, 2024 at 7:40 am[…] will encounter different market environments throughout your investing life, so don’t get too confused about whether now is the right time to […]